Italy starting Davis Cup title defense against Brazil and US plays Chile

LONDON (AP) — Italy will kick off the defense of its Davis Cup title against Brazil in Bologna on Sept. 11.

The full schedule of the Davis Cup Finals group stage was announced on Thursday, with all the matches taking place from Sept. 10-15 across four cities.

Italy will also play against the Netherlands and Belgium in Group A.

The United States — which has won the competition a record 32 times — starts its campaign also on Sept. 11, against Chile in Zhuhai, China, before then going on to play Slovakia and Germany.

Australia, which has finished runner-up in the past two years, plays France in Valencia on Sept. 10. The Czech Republic and Spain are also in Group B.

Britain faces 2022 champion Canada on the final day in Manchester, with Finland and Argentina completing Group D.

Jannik Sinner led Italy to its first Davis Cup title in nearly five decades in November in Malaga.

This year’s final eight will also be held in the Spanish city from Nov. 19-24.

___

AP tennis: https://apnews.com/hub/tennis

Related articles

Air National Guard changes in Alaska could affect national security, civilian rescues, staffers say

ANCHORAGE, Alaska (AP) — Kristin Paniptchuk’s water broke on Christmas Eve at her home in the wester2024-04-19

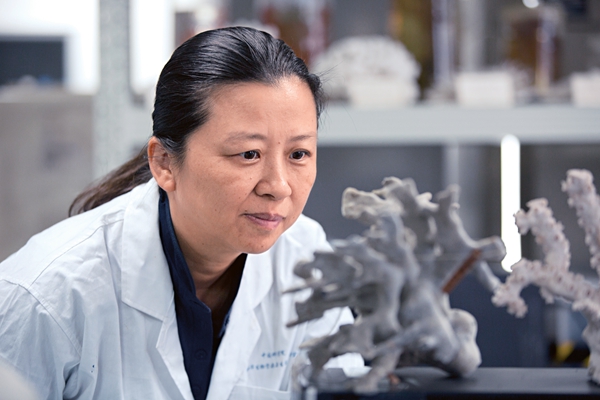

3D printed storage box to further propel China's lunar mission

(ECNS) -- The propulsion system of the Tiandu-1, an experimental satellite for communication and nav2024-04-19 A freight train loaded with anti-COVID-19 supplies prepares to depart for Hong Kong from Shenzhen, s2024-04-19

A freight train loaded with anti-COVID-19 supplies prepares to depart for Hong Kong from Shenzhen, s2024-04-19 People look at a frozen fountain at Bryant Park in New York, the United States, on Jan. 2, 2018. Peo2024-04-19

People look at a frozen fountain at Bryant Park in New York, the United States, on Jan. 2, 2018. Peo2024-04-19

US says China is funding America’s fentanyl crisis — Radio Free Asia

China is funding the United States’ fentanyl crisis by using tax rebates to subsidize the manufactur2024-04-19

Sculpture erected to create awareness on neurological disease in Brazil

Photo taken on Nov. 29, 2017 shows a sculpture of a giant foot stepping on hot coals, of Brazilian a2024-04-19

atest comment